Trading and investing to the USA stock market.

- Public Group

- Stock market

Recent Updates

- Bond yields will allow stocks to rise. At 2.250%, resistance was encountered. Back to the previous one at 2.066%. I think it will probably act as support. And then with the growth of the stock market will fall to 1.698%. But again, in the long run, as long as inflation is high it will come back and break the high.

For stock traders, the interest rate on stocks only tells us whether the market as a whole will rise or fall. Because there is a logical correlation. In the event of turbulence, investors prefer solid instruments, especially if the rate is high. If the rate falls, however, there is an overflow into the stock market.

Bond yields will allow stocks to rise. At 2.250%, resistance was encountered. Back to the previous one at 2.066%. I think it will probably act as support. And then with the growth of the stock market will fall to 1.698%. But again, in the long run, as long as inflation is high it will come back and break the high. For stock traders, the interest rate on stocks only tells us whether the market as a whole will rise or fall. Because there is a logical correlation. In the event of turbulence, investors prefer solid instruments, especially if the rate is high. If the rate falls, however, there is an overflow into the stock market.0 Comments 0 Shares6Please log in to like, share and comment! - The key rate was raised to 0.5% point. There are seven hikes planned for this year. This step is necessary because inflation is increasing, is already 7% for last year. At this point, it will accelerate even more because of rising energy prices. For the stock market on the one hand it is a negative action. Because corporations are using borrowed funds to develop their businesses. The more expensive they are, the more difficult and less effective it is to do business. But historically, if you pull up the statistics, the market does go up after the rise. Having experienced a brief decline.

At the time of writing, the market has rebounded from a local decline on this news. But I still expect a pullback down, because the growth of the market is too early. I expect its full-fledged growth a little later.

The key rate was raised to 0.5% point. There are seven hikes planned for this year. This step is necessary because inflation is increasing, is already 7% for last year. At this point, it will accelerate even more because of rising energy prices. For the stock market on the one hand it is a negative action. Because corporations are using borrowed funds to develop their businesses. The more expensive they are, the more difficult and less effective it is to do business. But historically, if you pull up the statistics, the market does go up after the rise. Having experienced a brief decline. At the time of writing, the market has rebounded from a local decline on this news. But I still expect a pullback down, because the growth of the market is too early. I expect its full-fledged growth a little later.0 Comments 0 Shares7 - The recruitment of a short position by a major player is not possible by only pressing down on the instrument. To gain a position, the player sometimes with the help of a gap or a sharp upward move of the price enters. Traders open positions on a long, think that the instrument has turned, thus then when they are swallowed and go down, stop-loss orders are collected. At this point in the market, there is no clear justified position for a reversal. Therefore, we wait to see what happens next.

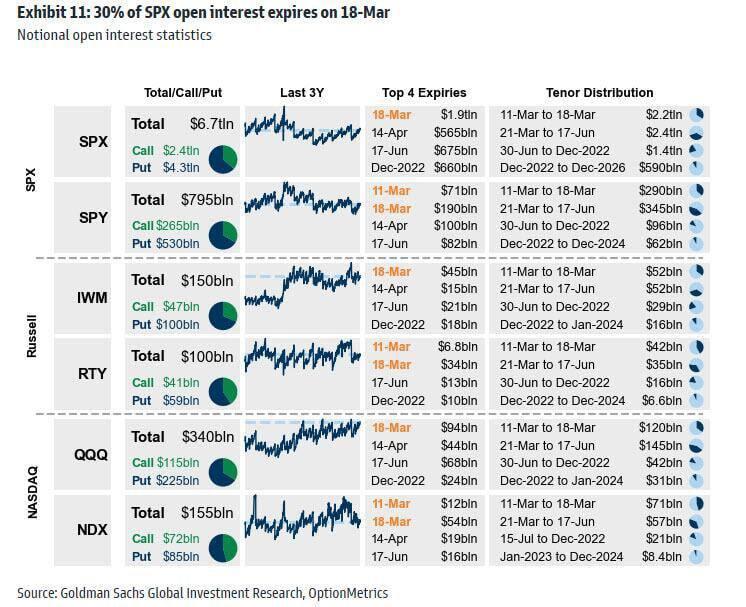

#SPX #Trading #StockThe recruitment of a short position by a major player is not possible by only pressing down on the instrument. To gain a position, the player sometimes with the help of a gap or a sharp upward move of the price enters. Traders open positions on a long, think that the instrument has turned, thus then when they are swallowed and go down, stop-loss orders are collected. At this point in the market, there is no clear justified position for a reversal. Therefore, we wait to see what happens next. #SPX #Trading #Stock0 Comments 0 Shares6 - ❗️🇺🇸 March 18 - $3.3 trillion expiration in U.S. stock options

Goldman: 30% of all open interest in U.S. stock index options will be on expiry March 18

This means very high volatility in the market. Be careful with your positions❗️🇺🇸 March 18 - $3.3 trillion expiration in U.S. stock options Goldman: 30% of all open interest in U.S. stock index options will be on expiry March 18 This means very high volatility in the market. Be careful with your positions0 Comments 0 Shares6 - #BABA

The stock has already unloaded enough, but the closest support is only around $57-60. Overall, this is not a good time for Chinese ADRs . Therefore, for the time being, fall until the situation improves, then rebound from the support zone to $130.

Upside +- 150%#BABA The stock has already unloaded enough, but the closest support is only around $57-60. Overall, this is not a good time for Chinese ADRs . Therefore, for the time being, fall until the situation improves, then rebound from the support zone to $130. Upside +- 150%0 Comments 0 Shares5 - #AMZN

Amazon announced a 20k1 stock split. This means that there will now be 20 times as many. You will have 20 instead of one. The cost will also go down by a factor of 20. That's a plus, how much more investors will be able to buy it. Considering going long.

#AMZN Amazon announced a 20k1 stock split. This means that there will now be 20 times as many. You will have 20 instead of one. The cost will also go down by a factor of 20. That's a plus, how much more investors will be able to buy it. Considering going long.0 Comments 0 Shares5 - #PFE Pfizer The share unloaded well. Now it looks better than the market. And together with the movement of the index it can go even higher. I expect the minimum target at 55.#PFE Pfizer The share unloaded well. Now it looks better than the market. And together with the movement of the index it can go even higher. I expect the minimum target at 55.0 Comments 0 Shares4

- My today signals. 9/9. Longs and ShortsMy today signals. 9/9. Longs and Shorts0 Comments 0 Shares4

-

-

More Stories