- Male

- 19/06/1991

- Followed by 59 people

Basic Info

- Field of activity

7 - work experience

trading

Friends 59

Recent Updates

-

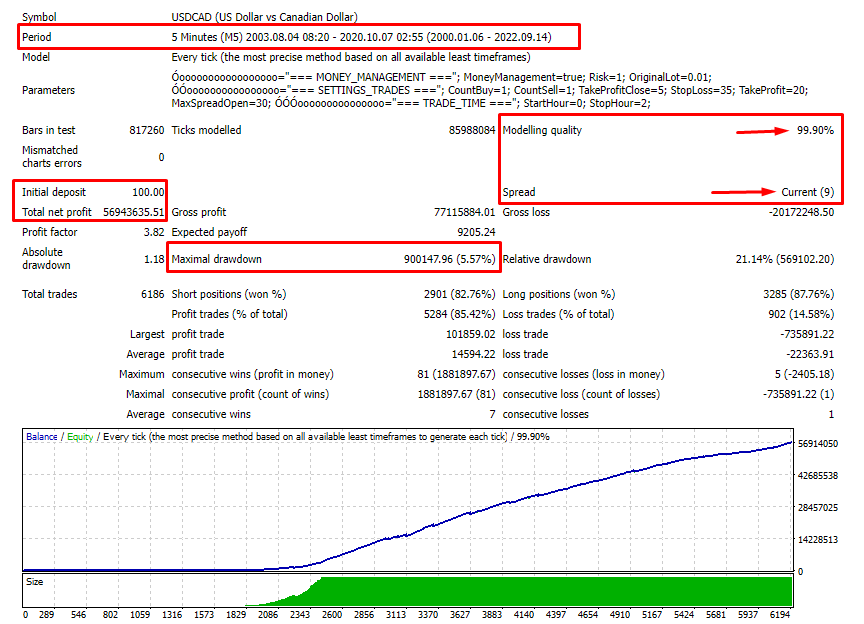

⭐️Only 3 copies left at $99 Next price $149 ⭐️

EA DonCorleone 👉 https://www.mql5.com/en/market/product/86065?source=Site+Market+MT4+Expert+Search+Rating006%3adoncorleone⭐️Only 3 copies left at $99 Next price $149 ⭐️ EA DonCorleone 👉 https://www.mql5.com/en/market/product/86065?source=Site+Market+MT4+Expert+Search+Rating006%3adoncorleone0 Comments 0 Shares4Please log in to like, share and comment! - How Can Putin Afford War In Ukraine? His $130 Billion Gold Hoard Helps

How can Russian President Vladimir Putin afford the costs—both direct and indirect—of a new war in Ukraine? Easy—he’s been preparing for years. Russia’s central bank reserves now stand at $640 billion, a record. That pile is equivalent to 17 months of Russian export revenues, and continues to grow, thanks to surging oil prices.

Russia exports some 5 million barrels per day of crude oil, plus 2.5 million bpd of refined petroleum products, according to Cowen & Co., amounting to about 10% of the global oil trade. With Brent crude hitting an eight-year high of $88.88 this morning, that amounts to more than $600 million a day in petro-cash.

On top of that is 23 billion cubic feet per day of natural gas exports (roughly 2 bcfd of which now transits through Ukraine)—worth another $400 million a day at today’s elevated European prices.

Importantly, it’s no longer apt to refer to Russia’s fossil fuel income as “petro-dollars,” as Putin has been working hard to “de-dollarize” the Russian economy. Back in 2013 Russia received dollars for 95% of its exports to Brazil, India, South Africa and China. Today, according to the Congressional Research Service, after a decade of de-dollarization just 10% of that trade is in greenbacks.

And Putin has created new payment processing systems, as a replacement for the Society for Worldwide Interbank Financial Telecommunication, or SWIFT (from which Biden has threatened to cut Russia off); in 2015 after U.S. sanctions Moscow launched the Mir payment platform (now even connected to Apple Pay).How Can Putin Afford War In Ukraine? His $130 Billion Gold Hoard Helps How can Russian President Vladimir Putin afford the costs—both direct and indirect—of a new war in Ukraine? Easy—he’s been preparing for years. Russia’s central bank reserves now stand at $640 billion, a record. That pile is equivalent to 17 months of Russian export revenues, and continues to grow, thanks to surging oil prices. Russia exports some 5 million barrels per day of crude oil, plus 2.5 million bpd of refined petroleum products, according to Cowen & Co., amounting to about 10% of the global oil trade. With Brent crude hitting an eight-year high of $88.88 this morning, that amounts to more than $600 million a day in petro-cash. On top of that is 23 billion cubic feet per day of natural gas exports (roughly 2 bcfd of which now transits through Ukraine)—worth another $400 million a day at today’s elevated European prices. Importantly, it’s no longer apt to refer to Russia’s fossil fuel income as “petro-dollars,” as Putin has been working hard to “de-dollarize” the Russian economy. Back in 2013 Russia received dollars for 95% of its exports to Brazil, India, South Africa and China. Today, according to the Congressional Research Service, after a decade of de-dollarization just 10% of that trade is in greenbacks. And Putin has created new payment processing systems, as a replacement for the Society for Worldwide Interbank Financial Telecommunication, or SWIFT (from which Biden has threatened to cut Russia off); in 2015 after U.S. sanctions Moscow launched the Mir payment platform (now even connected to Apple Pay).0 Comments 0 Shares5 - Look what my adviser is doing. And this is the result in just 2 weeks!

https://www.mql5.com/en/signals/1493474?source=Site+Signals+MyLook what my adviser is doing. And this is the result in just 2 weeks! https://www.mql5.com/en/signals/1493474?source=Site+Signals+My1 Comments 0 Shares7 - ‘Single Dumbest Thing They Could Do’—‘SPAC King’ Issues Stark Visa And Mastercard Crypto Warning As The Price Of Bitcoin, Ethereum, BNB, XRP, Solana And Cardano Surge

Billy BambroughSenior Contributor

I write about how bitcoin, crypto and blockchain can change the world.

Visa V +1.2% and Mastercard MA +2%, two of the world's biggest payment processors, have come under pressure from bitcoin, ethereum and decentralized finance (DeFi) projects over the last year—with Tesla billionaire Elon Musk and others speculating dogecoin could "truly be the future currency of the internet."

Subscribe now to Forbes' CryptoAsset & Blockchain Advisor and successfully navigate the crypto price roller coaster

The bitcoin, ethereum and crypto price boom—pushing the combined crypto market to around $2 trillion from under $500 billion in just 18 months—has sparked a wave of blockchain-based development, including in high-tech ethereum rivals such as solana and cardano.

Now, Chamath Palihapitiya, a former Facebook executive who runs the venture capital fund Social Capital, has warned there's "a swarm of activity coming to dismantle" Visa and Mastercard.

‘Single Dumbest Thing They Could Do’—‘SPAC King’ Issues Stark Visa And Mastercard Crypto Warning As The Price Of Bitcoin, Ethereum, BNB, XRP, Solana And Cardano Surge Billy BambroughSenior Contributor I write about how bitcoin, crypto and blockchain can change the world. Visa V +1.2% and Mastercard MA +2%, two of the world's biggest payment processors, have come under pressure from bitcoin, ethereum and decentralized finance (DeFi) projects over the last year—with Tesla billionaire Elon Musk and others speculating dogecoin could "truly be the future currency of the internet." Subscribe now to Forbes' CryptoAsset & Blockchain Advisor and successfully navigate the crypto price roller coaster The bitcoin, ethereum and crypto price boom—pushing the combined crypto market to around $2 trillion from under $500 billion in just 18 months—has sparked a wave of blockchain-based development, including in high-tech ethereum rivals such as solana and cardano. Now, Chamath Palihapitiya, a former Facebook executive who runs the venture capital fund Social Capital, has warned there's "a swarm of activity coming to dismantle" Visa and Mastercard.0 Comments 0 Shares7 - Top Stocks To Buy This Week

New Fortress Energy, Inc. (NFE)

New Fortress Energy, Inc. (NFE) closed down 0.5% Friday to $41.65 per share, boasting over 1.28 million trades. The stock still sits up a whopping 72.5% for the year. Our AI rates New Fortress Energy A in Growth, C in Low Volatility Momentum, and D in Technicals.

Tellurian TELL +1.8%, Inc. (TELL)

Tellurian, Inc. (TELL) closed up almost 2% Friday to $5.75, adding to the stock’s nearly 87% gains YTD. The company’s shares traded almost 16.55 million times throughout the trading session. Our AI rates the company B in Technicals, D in Growth, and F in Low Volatility Momentum and Quality Value.

Alibaba Group Holding Limited (BABA)

Alibaba Group Holding Limited (BABA) slipped 0.7% during Friday’s session, closing the day at $103.53 per share. The stock traded 20.8 million times during the day before ending down 12.85% for the year. Our AI rates Alibaba A in Quality Value, C in Growth, and D in Technicals and Low Volatility Momentum.

Snap SNAP -2.4%, Inc. (SNAP)

Snap, Inc. (SNAP) slipped 1.6% Friday, closing down 24% for the year at $35.67 per share. The stock saw over 21.7 million shares change hands on the day, with its final price falling nearly in line with its 22-day price average. Our AI rates Snap, Inc. D in Technicals, Growth, Low Volatility Momentum and Quality Value.

Seagen, Inc. (SGEN)

Seagen, Inc. (SGEN) dropped 2.7% Friday to $151.84 per share, slipping down 1.8% for the year. The company saw nearly 3 million trades on the day as shares remained nearly $9 over its 22-day price average. Our AI rates Seagen, Inc. C in Low Volatility Momentum, D in Growth, and F in Technicals and Quality Value.Top Stocks To Buy This Week New Fortress Energy, Inc. (NFE) New Fortress Energy, Inc. (NFE) closed down 0.5% Friday to $41.65 per share, boasting over 1.28 million trades. The stock still sits up a whopping 72.5% for the year. Our AI rates New Fortress Energy A in Growth, C in Low Volatility Momentum, and D in Technicals. Tellurian TELL +1.8%, Inc. (TELL) Tellurian, Inc. (TELL) closed up almost 2% Friday to $5.75, adding to the stock’s nearly 87% gains YTD. The company’s shares traded almost 16.55 million times throughout the trading session. Our AI rates the company B in Technicals, D in Growth, and F in Low Volatility Momentum and Quality Value. Alibaba Group Holding Limited (BABA) Alibaba Group Holding Limited (BABA) slipped 0.7% during Friday’s session, closing the day at $103.53 per share. The stock traded 20.8 million times during the day before ending down 12.85% for the year. Our AI rates Alibaba A in Quality Value, C in Growth, and D in Technicals and Low Volatility Momentum. Snap SNAP -2.4%, Inc. (SNAP) Snap, Inc. (SNAP) slipped 1.6% Friday, closing down 24% for the year at $35.67 per share. The stock saw over 21.7 million shares change hands on the day, with its final price falling nearly in line with its 22-day price average. Our AI rates Snap, Inc. D in Technicals, Growth, Low Volatility Momentum and Quality Value. Seagen, Inc. (SGEN) Seagen, Inc. (SGEN) dropped 2.7% Friday to $151.84 per share, slipping down 1.8% for the year. The company saw nearly 3 million trades on the day as shares remained nearly $9 over its 22-day price average. Our AI rates Seagen, Inc. C in Low Volatility Momentum, D in Growth, and F in Technicals and Quality Value.0 Comments 0 Shares5 - ‘Pay In Doge?’—Elon Musk’s Surprise Twitter Plan Could Sideline Bitcoin And Ethereum In Favor Of Dogecoin After Boosting Its Price

Elon Musk, the dogecoin-backing Telsa billionaire who sent shockwaves through the bitcoin, crypto and tech world when he revealed he'd bought around 9% of Twitter this month, has posted a flurry of improvement suggestions in recent days.

Subscribe now to Forbes' CryptoAsset & Blockchain Advisor and successfully navigate the latest crypto price rally

Amid a Twitter thread that called for everyone who signed up for Twitter's $3 per month paid service, Twitter Blue, to "get an authentication checkmark," Musk added, "maybe even an option to pay in doge?"—renewing his support for the meme-based bitcoin rival after its price has crashed dramatically from its 2021 highs.

Want to stay ahead of the market and understand the latest crypto news? Sign up now for the free CryptoCodex—A daily newsletter for crypto investors and the crypto-curious‘Pay In Doge?’—Elon Musk’s Surprise Twitter Plan Could Sideline Bitcoin And Ethereum In Favor Of Dogecoin After Boosting Its Price Elon Musk, the dogecoin-backing Telsa billionaire who sent shockwaves through the bitcoin, crypto and tech world when he revealed he'd bought around 9% of Twitter this month, has posted a flurry of improvement suggestions in recent days. Subscribe now to Forbes' CryptoAsset & Blockchain Advisor and successfully navigate the latest crypto price rally Amid a Twitter thread that called for everyone who signed up for Twitter's $3 per month paid service, Twitter Blue, to "get an authentication checkmark," Musk added, "maybe even an option to pay in doge?"—renewing his support for the meme-based bitcoin rival after its price has crashed dramatically from its 2021 highs. Want to stay ahead of the market and understand the latest crypto news? Sign up now for the free CryptoCodex—A daily newsletter for crypto investors and the crypto-curious0 Comments 0 Shares4 -

- Nubank Is Now Worth $30 Billion After $750 Million Investment Led By Berkshire

On Tuesday, Berkshire Hathaway disclosed a $500 million investment in Brazil-based digital bank Nubank, which is among the most valuable private startups in the world. The investment came as part of a broader funding round that raised a total of $750 million and increased Nubank’s post-money valuation from $25 billion to $30 billion, according to a source familiar with the matter. This new valuation places the digital bank slightly behind Banco Bradesco, one of Brazil’s top banks, with a market value of $40.9 billion.Nubank Is Now Worth $30 Billion After $750 Million Investment Led By Berkshire On Tuesday, Berkshire Hathaway disclosed a $500 million investment in Brazil-based digital bank Nubank, which is among the most valuable private startups in the world. The investment came as part of a broader funding round that raised a total of $750 million and increased Nubank’s post-money valuation from $25 billion to $30 billion, according to a source familiar with the matter. This new valuation places the digital bank slightly behind Banco Bradesco, one of Brazil’s top banks, with a market value of $40.9 billion.0 Comments 0 Shares6 -

More Stories